Get This Report on Worker's Compensation

Wiki Article

Not known Details About Worker's Compensation

Table of ContentsThe 6-Second Trick For Worker's CompensationThe Definitive Guide to Worker's CompensationThe smart Trick of Worker's Compensation That Nobody is Talking AboutUnknown Facts About Worker's Compensation8 Simple Techniques For Worker's CompensationThe Ultimate Guide To Worker's CompensationHow Worker's Compensation can Save You Time, Stress, and Money.

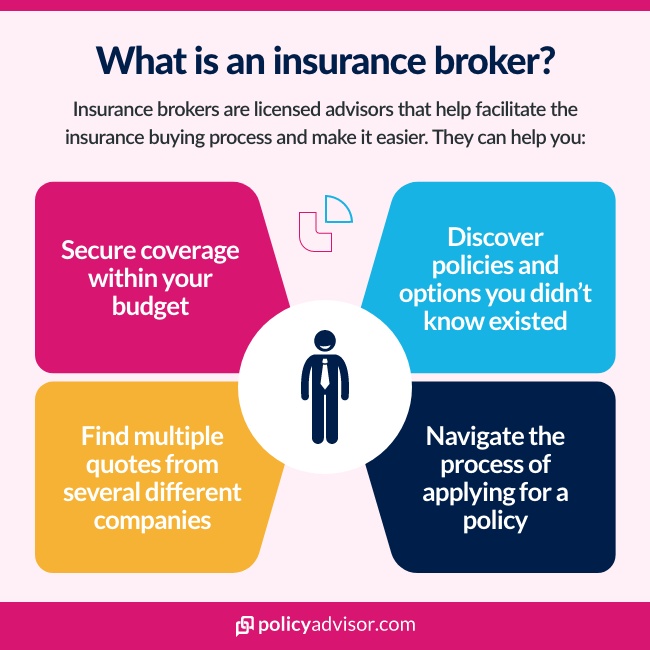

The occupation of insurance policy broker basically consists in. They work with clients, offering them a selection of insurance items to fit their needs, An insurance policy broker is paid by insurance companies when they find them brand-new clients.Here are some benefits of making use of an insurance policy broker. One of their main jobs is to compare the different products provided by the business to which they have accessibility.

The broker's after that enable them to choose from among the many existing insurance coverage products that offer the for their customers. With accessibility to a range of insurance coverage products, an insurance broker can help you locate the plan that finest suits your requirements and budget. They will certainly initially examine your circumstance as well as then, after, choose several contracts.

Worker's Compensation Fundamentals Explained

They are for that reason your primary call for suggestions or to bargain your agreement. Brokers have than a regular client. Worker's Compensation. They usually represent several tens or numerous contracts, which provides more weight when the time concerns renegotiate rates or to manage an event that has occurred. The insurance company has every interest in concerning a contract with the broker if it wants to continue its partnership.

The Only Guide to Worker's Compensation

When an insurance policy company has an excess of funds from costs, it will securely invest this cash to produce earnings. What is the distinction in between an insurance business as well as an agency?Insurance policy firms are companies of the item, while firms are service providers of the service, dispersing the item to customers. What are the benefits and drawbacks of an insurer? The following is just one of one of the most substantial pros of choosing an insurer as your supplier: Straight carrier: An insurance provider is the provider of an insurance plan.

The cons of choosing an insurer as your provider include: Impersonal solution: You will not get the personalized solution from an insurance provider that you can get from an agent or broker. If you intend to deal with a person that takes your special requirements right into factor to consider, you might desire to deal with an agent or broker rather.

The Of Worker's Compensation

What is the difference between an insurance broker as well as a representative? While both agents and brokers collaborate with insurance firms as well as insurance customers, they vary in that they stand for throughout the acquiring process. An insurance representative represents each of the insurance coverage carriers they work with, while an insurance broker stands for over at this website the insurance coverage purchaser - Worker's Compensation.

Better plan choices: When you collaborate with an independent representative, they can contrast different insurer to locate you the very best policy. No cost: You do not need to pay a hourly fee or a consulting cost to deal with an insurance policy representative. You'll additionally pay the exact same cost whether you acquire your plan through an insurance coverage agent or straight from the insurance policy business.

What Does Worker's Compensation Mean?

While a representative stands for insurance policy firms, brokers stand for the customers - Worker's Compensation. What are the pros and also disadvantages of an insurance policy broker?Quality differs per broker agent company: Not every insurance policy broker offers the same high quality of service, so you may want to shop around before selecting to collaborate with a brokerage firm. Remember the advantages and disadvantages of collaborating with an insurance broker when choosing an insurance service provider. Gunn-Mowery offers the very best of both globes as both an insurance policy firm and also an insurance policy broker.

Insurance coverage Brokers have to have a deep understanding of the insurance market to do their task successfully and also keep up to day on new plans as well as promos, which they will commonly obtain information regarding from insurance coverage business. Other responsibilities usually include conference as well as interviewing brand-new clients, calling Insurance Adjusters and also clinical supervisors when needed, and also calling clients and also insurance coverage business concerning settlement concerns.

How Worker's Compensation can Save You Time, Stress, and Money.

Join our A Plus Insurance coverage Household and also let us do the purchasing for you Insurance brokers are licensed experts (qualified according to state regulations) and are there to aid make your insurance policy purchasing easier.An insurance policy agent is a qualified specialist that markets insurance policy plans directly to the customer on part of one or even more insurance companies. An insurance policy broker represents the clients.

There are click site insurance coverage brokers for home, automobile, wellness as well as life insurance policy. An insurance broker represents insurance customers, not insurance provider. A broker remains in learn this here now company by collecting payments on insurance policy sales, and the job of a broker is to discover inexpensive prices on plans for vehicle drivers and also home owners. They're professionals in insurance coverage, as well as your pleasant broker is experienced in assisting you decide what the very best coverage choices are for your distinct situations.

The 7-Minute Rule for Worker's Compensation

An additional benefit of mosting likely to a broker for insurance is that it's a reduced pressure experience. The broker has no reward to sell you on one certain plan and is flexible when it concerns helping locate protection at a price you can pay for. You can get a quote for the very same protection from several various insurance firms as well as, because it's an affordable environment, there's a motivation for insurance providers to supply economical rates and also sensible insurance coverage options.Report this wiki page